8 Best Precious Metals IRA Companies in 2023

American Hartford Gold is headquartered out of Los Angeles, California, and has been in business for six years. That being said, the company is also quite infamous for its relatively slow transaction speeds. Birch Gold Group is a California based company that has been in the retirement planning and precious metals industry for over two decades. You can also use your physical gold bullion to purchase government bonds. Buyers are told the coins will only go up in value because of their rare or collectible nature. The lower the levels of purity, the lower the price. Silver IRA: Similar to a Gold IRA, a Silver IRA allows individuals to invest in physical silver bullion or coins within an individual retirement account. These aren’t serious red flags that should make you run for the hills but they might make Noble Gold Investments the wrong choice for you. No commissioned sales best silver ira reps. Birch Gold has a team of experienced professionals who provide personalized guidance and advice when it comes to gold IRA investments. As for the platform’s gold selection, you can buy assets like American Eagles, Canadian Maple Leafs, American Eagle Proofs, Gold Canadian Eagles, American Buffalo, and Australian Striped Marlin. To get the process rolling, all you need to do is to contact your current administrator.

11 GoldBroker: Best For Transparent Gold Trading

The company has a large selection of IRS approved precious metals, making it easy for its customers to make the correct selections. Once you retire and eventually withdraw your funds, you will pay taxes on those withdrawals. The following gold chart shows the price trajectory from August 5th, 1997, when precious metal IRA accounts were enacted, through May 22nd, 2023. These are the most trusted and secure precious metals storage facilities in the United States. If so, which companies have you used, and what was your experience like. The flat rate fee structure is relatively high for small investors. Investing in gold for retirement can help you achieve your financial goals and secure your financial future. The American Hartford Gold Group is a full service precious metals firm, offering a variety of investment options to help clients protect and grow their wealth. The best silver IRA companies make the information regarding IRAs accessible and easy to understand. Work with a gold IRA company that charges NO FEES for up to 10 years. Join Gold Alliance and Unlock a World of Possibilities. With continued support provided all along the way through dedicated personal representatives, clients can rest assured knowing their investments are managed responsibly and securely every step of the way towards achieving financial independence later in life.

:max_bytes(150000):strip_icc()/gold_ap11091515585-5bfc376246e0fb00511cc344.jpg)

How To Get Started

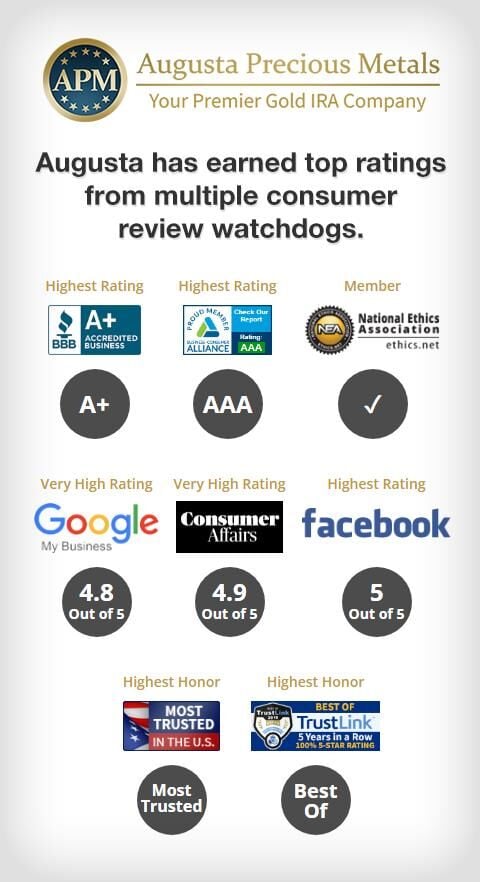

They offer personalized advice, a secure, user friendly platform, and a secure storage facility. You should research carefully to ensure you are selecting the right company. While the company’s focus is on precious metals IRAs, it also offers direct purchases of gold and silver and several storage options in IRS compliant depositories. The information provided should be unbiased, professional, up to date, and based on facts. Their A+ rating from the Better Business Bureau and a TrustScore of 5 out of 5 based on 121 reviews demonstrate their commitment to customer satisfaction. Tax laws and regulations are complex and subject to change, which can materially impact results. American Hartford Gold has transparent pricing and reasonable IRA fees. As a result, commissions and profits often drive their recommendations. Customers work directly with the company owners to ensure a consistently high level of satisfaction. Market prices are volatile and unpredictable and may rise and fall over time. Gold and Silver IRAs also provide tax benefits for investors. Application versioning and licensing.

Is a Gold or Silver IRA Right for You?

Hold your gold until maturity: If you need access to your IRA funds, you can take distributions from your gold IRA like a traditional IRA. They take pride in offering exceptional customer service, unparalleled product quality, and a 100% satisfaction guarantee. You can name the beneficiaries to your IRA when you establish the account and you may change the beneficiaries at any time. You can visit their website to register and receive a free instructional manual. For specific pricing, you’ll need to contact customer service. 9999 fineness with a unique serial numbers. There won’t be any surprises if any price changes are communicated beforehand. Meanwhile, silver production from mining is on a decline that is expected to continue for at least the next decade. After which, your custodian of the newly opened IRA account will send funds to Accurate Precious Metals to pay for the new metals and we will ship them to a secure depository. ✅ $50,000 minimum investment. If you designate a Representative, it’s the equivalent of giving that person or company a Power of Attorney. No matter which type of investment you decide upon, always do your due diligence before making any purchase so that you understand what you’re getting into and can make informed decisions about where your cash is going. A gold professional can provide further context and answer any questions about gold IRAs you may have.

Software and Business

Hence, purchasing shares in different ventures is a safety net cushioning them against losses when one business goes bankrupt. My IRA Is “Self Directed. If you have a precious metals IRA, your IRA directly owns physical bullion bars or coins that you select and order directly. Speak with a financial advisor about whether a precious metal IRA is right for your retirement goals and financial situation. All information submitted by loan applicants is subject to verification. Any products falling outside of these ranges, excluding American Gold Eagles, are not approved for precious metals IRAs. Some gold IRA companies operate within a cloak. Rollover funds to your new self directed IRA account. The IRS has strict guidelines on the types of gold and silver that can be included in a precious metals IRA, so it’s important to ensure that your investments meet these requirements.

Watch More

It has over 2000 five star reviews on Trustpilot and Consumer Affairs. Choose the account that’s right for you, and complete your online application in 15 minutes or less. They are a professional company and do a great job in ensuring your investment process is handled correctly. Costs for a gold IRA will depend on the specific gold IRA company and fees charged, which typically include. The company’s extensive experience in handling gold investments and its comprehensive approach to helping clients make the most of their gold IRA rollover ensure a safe and secure gold investment experience. The best gold IRA rollover is one that fits your individual needs and financial situation.

Ratesetter – My Lender Experiences After 5+ Years

Both buyers and sellers can use the platform to exchange gold and other assets, and it even offers cryptocurrency payment options. There are a number of reasons to invest in a precious metals IRA, most notably consistent growth opportunity and tax benefits. Account set up fees: These one time costs usually range from $50 to $150. Dealers are firms or individuals who make deals for the sale and purchase of precious metals. There is also a helpline number that connects you to a specialist on their website if you need more in depth assistance. They also have many other materials in stock, including lead, magnesium and more. Therefore, customers should also stray away from silver IRA companies that are too costly. Many investors are looking for a safe and secure way to invest in gold and other precious metals. A gold certificate is simply a piece of paper that can be redeemed for physical gold. Precious metals and coins may appreciate, depreciate, or stay the same depending on a variety of factors. Before making any decision, you should seek advice from an attorney or tax professional. Taking this step upfront can help ensure that all possible deductions are maximized and your returns remain intact throughout retirement. Experience Unmatched Benefits with Advantage Gold.

Best Project Management Software for Educational Institutes

Big thanks to Noble Gold for increasing my precious metals investments and providing insight along the way. To simplify the process, a comprehensive ranking system was developed to help investors identify the best gold IRA companies. What to look out for: Lear Capital’s set up fees are on the higher side. Discover the Luxury of Oxford Gold: Experience the Difference Today. The best gold IRA companies make funding and managing your account easy. Real time updates and all local stories you want right in the palm of your hand. Depending on your goals when investing in gold and silver through a Roth IRA you should also keep track of current market prices so that you know when is the right time buy or sell specific assets within your portfolio accordingly. PAMP Swiss gold bar SN35427681. Below, we’ve listed some of the key differences between Gold IRA transfers and rollovers as well as certain core similarities. Noble Gold representatives simplify setting up an IRA or rollover IRA. Greater of: Minimum Fee of $75 per quarter/ $300 annually OR Annual Percentage Fee for segregatedMarket Value of Asset as a percentage of market valueLess than $100,000.

Fund Your Account

For example, the March 2020 OPEC+ oil crisis saw the price of gold hit a 7 year high. Not all precious metal pieces may be kept in an IRA due to certain IRS regulations. Refer to a professional for investment advice. Therefore, customers will have to pay if they want to open an account. The IRS also requires minimum distributions each year once you turn 70 1/2 or 72 if your birthday falls between certain dates. Keep in mind that you cannot fund your new IRA with precious metals that you already own, or that might be given to you by family or friends. Understanding these drawbacks can help you make an informed decision about whether a Gold IRA is the right choice for your investment portfolio. That fact in combination with the current, enduring market instability makes now a better time than ever to invest in silver. If you’re unsure where to get started with investing in gold, a knowledgeable member of our team will help you through the process, from opening your account to placing your investment. The marlin is a symbol of tenacity, perseverance and commitment.

Advantage Gold: Cons Silver IRA

The management of your IRA. A: Storage and maintenance fees for gold silver IRA accounts can vary depending on the custodian or broker used, as well as the amount and type of precious metals held in the account. Having said that, the company’s executive team are all veterans in the industry. Download Gold IRA Guide Now. Invest In Your Future With GoldCo: Start Today And Prosper. IRA amount options start at a minimum of $50,000, allowing customers to tailor their investment to their financial goals.

Apr 27, 2023

With a silver IRA, you can purchase physical silver coins and bars, or you can purchase silver ETFs or mutual funds. The ideal time to buy gold is when it is priced lower. Then your representative will help you purchase precious metals. The more people say good things, then the better the company is doing. Unlock the Benefits of Gold Alliance Membership. Please note that they may be expensive to manage, and you’ll have to adhere to strict IRS regulations to avoid penalties. A Gold and Silver IRA is simply a self directed individual retirement account that allows you to hold physical gold and silver. The IRA experts at Midas Gold Group are here to help you every step of the way to make sure you make an informed and educated decision.

Traditional IRA vs Roth IRA: Choosing the Right Retirement Account for Your Objectives

They are very patient with questions, and a pleasure to deal with. At this time, we have direct working relationships with two trust companies that offer self directed plans. They have a team of experienced IRA specialists who can help you set up your account and provide ongoing support. Celebrating the 20th anniversary of the Silver Britannia, this version of the Silver Britannia features a unique rim with “1997 2017” etched on the side. Physical gold or other approved precious metals are held in custody for the benefit of the IRA account owner. Rosland Capital distinguishes itself as a leading platform for investors with a passion for precious metals. They also provide competitive rates and secure storage solutions for silver investments. They must have a firm grasp of the rules, guidelines, and types of precious metals that qualify. The following factors should be taken into consideration. It is important to carefully review the fee schedule of any custodian you are considering before opening an account. Fees: A yearly administration fee of $100 and an annual precious metal storage fee of $150 fee is applicable. Write to Jeremy Harshman at jeremy. Just contact Kitco to place your order for gold and silver, and we will connect you to our preferred partners for retirement savings services. Honest Buy Back Policy.

SUBSCRIBE AND GET 5% OFFYOUR FIRST PURCHASE

RC Bullion has a long track record of providing quality service and expertise to their customers. If you have an eligible income, you will also be eligible for a Roth IRA. You can rollover or transfer funds from any existing IRA, 401k, 403b, and 457b accounts, or you can contribute directly to the account — up to $7,000 per year, depending on your age. Ultimately, adding precious metals to your portfolio adds diversification and can be a high growth long term investment. Alex, was a joy to work with, extremely efficient, knowledgeable, and responsive. Gold and silver have long been considered safe haven investments, as their prices tend to remain relatively stable.

COMPANY

The biggest difference is that you can maintain those tax benefits while experiencing the other benefits of purchasing precious metals. Unlock Your Financial Potential with Advantage Gold. These fees may cover. The benefit of a Self Directed IRA is that you can invest in what you know. Finding an IRA approved custodian or broker for silver investments can be a daunting task. From Beach Blvd go west on Edinger three lights. GET STARTED WITH ON OUR ONLINE APPLICATION HERE.

Please Select Your Free Award Winning Publications:

Lastly evaluate the fees associated a precious metals IRA. Their specialists are available to help with paperwork and answer any questions. With over two decades of experience in the industry, Augusta Precious Metals are the experts in precious metals investments. PAMP Swiss gold bar SN35427681. JavaScript seems to be disabled in your browser. Only high purity bullion products like the American Eagle, American Buffalo, and the Canadian Maple Leaf products are IRS approved to be held in a gold IRA. Greg is an expert in negotiating loans, and he has a proven track record of getting his clients the best possible terms. You acknowledge and understand third party grading and authentication of numismatics does not eliminate all risks associated with the grading of coins. GoldCo is dedicated to helping customers make the right decisions for their gold and silver IRA accounts.

We’re Welcoming Jeff Modeski as Columbia Office Branch Manager

This behavior by some of the world’s most powerful nations should be enough to convince you that gold and silver are the future. Are you prepared for an excellent retirement plan. Physical precious metals is a self directed investment and generally requires a custodian that offers self directed IRA investments. According to Internal Revenue Code Section 408m, a financial institution or a custodian that is approved by the IRS must physically hold precious metals IRA. Finally, you can make a minimum investment of $10,000 if you are making purchases for a retirement account. Their inventory changes daily as they sell out of popular items quickly. Experience Luxury with Oxford Gold – Shop Now. However, establishing a gold IRA can be a daunting task, as it requires selecting a gold IRA custodian, finding an approved depository for storing your gold, and navigating complex IRS tax regulations. There’s no one size fits all answer to this question, as everyone’s financial situation differs based on individual circumstances and risk profiles. The company’s experienced agents will guide you through each step of the process and ensure that you have all the information you need to make informed decisions about your retirement savings. It works just like an ordinary IRA, except instead of dealing in paper currency, it deals in physical bullion gold coins or bars.

Precious Metal Investing in a Hot Market

Choose the account that’s right for you, and complete your online application in 15 minutes or less. Prioritizes customer education. Customers can choose from a variety of gold and silver coins, bars, rounds, and bullion to invest in. A dealer’s membership in industry organizations such as the Industry Council of Tangible Assets, the Professional Numismatists Guild, and the American Numismatics Association is a sign of legitimacy. I was able to sign up with no problem. Finally, the best gold IRA companies will provide competitive rates and fees. In addition, look for custodians that specifically have experience with precious metals IRAs and IRA rollovers. While most of the available gold and silver bullion is at least 99. Custodians are financial institutions that have federal permits to store precious metals. In other words, investors should consider dedicating roughly this much of their portfolio’s total value to precious metals holdings such as gold, silver, or platinum. Most gold IRA companies have a buy back option, but the terms differ.

ÀmonAvis

The price of gold is averaging about $1748 per ounce in 2020. Invest in Your Financial Future with Birch Gold’s Secure Precious Metals Solutions. We are not financial advisors, financial planners or lawyers, and we always suggest you do your best. Whether you’re a novice or an experienced investor, Oxford Gold Group offers the perfect solution for your gold and silver IRA needs. Both forms of silver require careful consideration of storage options and buying sources to ensure a successful investment. After evaluating all these factors, the team was able to determine which silver IRA companies were the best and most reliable. Some of the most reputable Silver IRA companies are. You may roll over an existing retirement account IRA, 401k, TSP, pension to your self directed IRA. Silver American Eagle 99. “Mark Zaidan is a professional in every sense of the word.